Legacy & Personal Values

Irrespective of whether we are princes or paupers, we all leave a legacy. As important as it may be, that legacy is less about personal estates, personal accolades, and personal accomplishments than personal values! Legacy is all about behaving in alignment with a personal model of what good looks like and handing off its reflection to other people, places and institutions. Legacy is always a reflection of personal values and how those values live in behaviour.

Values are greatly influenced by current and past cultures. For example, we live in an era where personal values typically trump familial, societal, and institutional values. Since values are the prism through which we view the universe, hearing stories of a different time and place where people placed greater value on giving purpose to collective effort than personal goals, it is often difficult for us not to be dismissive or judgmental of the values of past generations. Frequently they just don’t fit with current ideas of what good looks like. I recently came across a story of a Canadian family of a century ago that left a powerful legacy in Ontario. As you read the article linked here, you will likely discover that the legacy of those in the story is one of bridges, highways, botanical gardens, and public works. However, you will also discover that their legacy is also about lives of personal sacrifice and giving purpose to collective effort.

It would be easy for us to dismiss the story as an example of values and customs that are out of touch with today’s realities. Maybe they are. However, this way of thinking would miss the point of the article. The article offers us an opportunity to reflect about our personal model of what good looks like against the backdrop of a bygone era.

Remember, our real values live in our behaviour. If you want to do a reality check on your true values, ask yourself what are you willing to fight for; then check your answers against the backdrop of your behaviours. This will likely get you closer to understanding your legacy as it stands right now.

Meaningful reflections!

Dr. Bill DeMarco

Roadmap to Inspiration in Stressful Times: Finding our “Better Angels”

Roadmap to Inspiration in Stressful Times:

Finding our “Better Angels”

by

Dr. William (Bill) DeMarco, Ph.D.

All generations have encountered stress. While stress most often feels unique to each of us, it is really a recurring element of the human condition that everyone experiences. Beyond the normal stressors of personal and family life, we are confronted with the additional stress of living in particularly challenging times. While I do not know whether this is significantly different from what other generations have encountered, I do know it is our current reality. What frequently feels like a constant bombardment of stress cries out for relief. Finding “better angels” may offer some as needed. This article is a roadmap on how to get there.

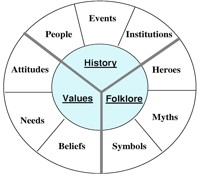

Let’s start off with a better understanding of culture, the modern reality we all live within. As I have frequently written in these pages, CULTURE is a living thing…being the sum total of the history , values, and folklore of a society at a given point in time. This is true for both societies and businesses of all sorts. Our current cultural “point in time” is particularly stressful, given the constant presence of “in your face” media. It impacts how we live, what we value, how we relate to one another, who our role models are, how and what we celebrate, what and how we eat…pray…and yes, even love.

Copyright, Dr. William DeMarco, 1993

Copyright, Dr. William DeMarco, 1993

I would not be surprised in the least if it comes to you that we live in precarious times, with the constant bombardment of media of all sorts. Institutions that have traditionally been bulwarks against dramatic and even unsettling change, have lost much of their lustre. Current history is creating a new set of values, reflected in the folklore of modern times, all becoming part of the culture going forward. Now that becomes a scary thought when we think of their impact on the future generations we are spawning.

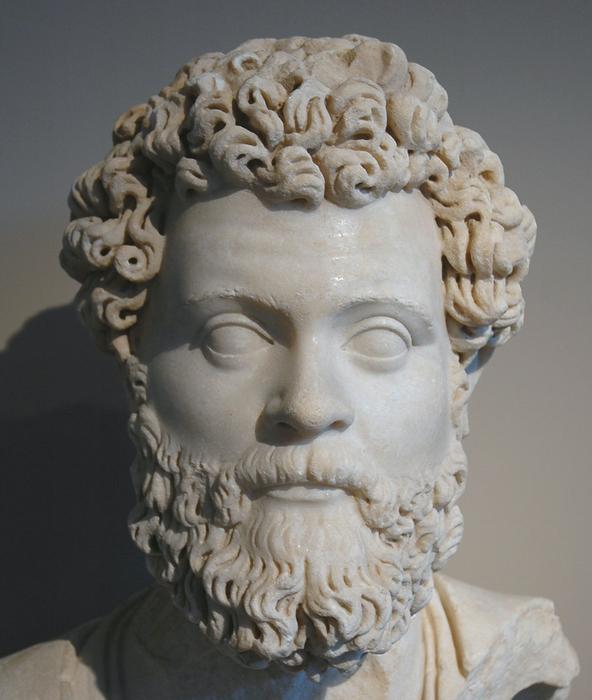

The reality is that fear of change has always been thus! The Stoics of ancient Roman  times wrote frequently about it. For example, the second century Roman Emperor, Marcus Aurelius (image) wrote in his famous book of “Meditations”:

times wrote frequently about it. For example, the second century Roman Emperor, Marcus Aurelius (image) wrote in his famous book of “Meditations”:

”Loss is nothing else but change, and change is Nature’s delight”

Not being able to see the future, we naturally fear it; for we cannot control what we do not see.

Another example is found in the Four Gospels of the New (Christian) Testament of the Bible. All four evangelists (Gospel authors) wrote about how the de facto ruling class of Pharisees feared the loss of power/status due to the teachings of Jesus Christ (image). Even the first century Jewish historian, Josephus, wrote about this. Jesus preached about another kingdom in ways that questioned elements of Pharisaic teachings about the next life; he even challenged the status quo by preaching that the greatest commandment of all is to “Love God with all your heart”….”And Love your neighbour as yourself”…for “the poor will always be with us”…so “feed the hungry, clothe the naked, care for the sick, shelter the homeless”, rather than preach about the preeminence of sacrificial offerings. In today’s parlance, this puts socialist principles above free enterprise. Today’s hot debates on these topics are not really that new after all!

Another example is found in the Four Gospels of the New (Christian) Testament of the Bible. All four evangelists (Gospel authors) wrote about how the de facto ruling class of Pharisees feared the loss of power/status due to the teachings of Jesus Christ (image). Even the first century Jewish historian, Josephus, wrote about this. Jesus preached about another kingdom in ways that questioned elements of Pharisaic teachings about the next life; he even challenged the status quo by preaching that the greatest commandment of all is to “Love God with all your heart”….”And Love your neighbour as yourself”…for “the poor will always be with us”…so “feed the hungry, clothe the naked, care for the sick, shelter the homeless”, rather than preach about the preeminence of sacrificial offerings. In today’s parlance, this puts socialist principles above free enterprise. Today’s hot debates on these topics are not really that new after all!

Christ also stated many times that He was the Son of God. Talk about a radical departure from the values of the day, even though the Jewish people had been waiting for their Messiah (a perceived temporal leader) for centuries. As the Pharisees saw it, how could a carpenter’s son from lowly Nazareth challenge their interpretations of scripture and the divine; so they contrived to have him executed by the legal protocols of the day.

Here we have another example of fear of change and loss of control. Human beings have never handled change well, in spite of the fact that like death, it is a certainty that both change and death are in all of our futures. In spite of all of today’s doom and gloom – sorry to be so maudlin here- centuries of human history can also provide us with solace and comfort.

Herodotus (image), frequently referred to as the “Father of History”, wrote thousands of years  before Christ that history is less about reality (i.e.facts) than about relevance. His writings tried to inspire all future generations to think less about the “who”…the “what”…the “when”, but more about the relevance of human realities

before Christ that history is less about reality (i.e.facts) than about relevance. His writings tried to inspire all future generations to think less about the “who”…the “what”…the “when”, but more about the relevance of human realities

What comes to my mind immediately is what life was like for my grandparents and great grandparents, immigrants all living through the relevance of their 1890’s realities; realities which happen to be quite similar to those of modern times. Here is a partial list of their stressors: natural disasters, prejudice, tribalism, greed, entitlement of class structure, ineffective political systems, corrupt financiers, faulty institutions, terrorism, and a sense of helplessness. Quite a list; similar to what most of today’s refugees face.

Most importantly, though, for all this , they believed in the existence of “better angels”. Family stories show this. They saw their lives as better than in the old world because they had dreams that they believed could become a reality: financial opportunity, helping hands and big hearts of family, caring friends and agencies, labor unions, as well as inspiring and helpful social & religious institutions, and education for next generations, just to name a few.

Their experiences were no worse than those of so many other “societies” or sub-cultures, frequently referred to as hyphenates (i.e. -Canadians, -Americans, -Asians, -Europeans, etc.). Of course, tribalism was present in all the miseries of these souls, frequently showing up in their attitudes towards others, but the fortunate ones focused far more on the relevance to their lives at a far more granular level. Sure, tribalism with its ‘blame game”was present, but food, shelter, housing, financial security, and how to relate to one another proved to be far more important in their daily lives.

It was as if they were channelling Seneca, the great first century stoic, when he wrote:

“Associate with people who are likely to improve you

When fear of change and genuine disgust with the ethical bankruptcy of modern times gets you down, focus on the “better angels” of more recent times who inspire you. Start off with family stories from current and past generations. It is important to celebrate the moments of their lives that inspire you; these always have special significance.

In addition, many of my clients/adult students have been inspired by the lives of the following: Mother Theresa, Nelson Mandela, Benazir Bhutto, Susan B. Anthony, Clara Barton (image), Tommy Douglas, Winston Churchill, Damien of Molokai, Terry Fox, Viktor Frankl, Frederick Douglass, Anwar Sadat, Maximillan Kolbe, Dr. Tom Dooley, Jesus Christ, Dr. Martin Luther King Jr., Dr. Albert Schweitzer, Sacajawea, Thomas Merton, Jimmy Carter, Mahatma Ghandi, George Marshall, Lech Walesa, Anthony deMello, etc. Take a look at their (click) biographies , podcasts, or anything else you can get your hands on.

[For more inspirational reading suggestions , please click here.]

Here is another person to think about; he was a man who made a difference in his many leadership “moments of truth”. Thomas “Tip” O’Neil, the Speaker of the U.S. House of Representatives in the 1980’s, was a physical and political giant of a man. He built meaningful political coalitions in a difficult political environment. He was a man of the people, as he expressed in his oft-repeated prescient statement:

“All politics is local”

“All politics is local”

Tip O’Neil was genuinely inspiring when it counted most. His “all politics is local” became a clarion call for people of diverse political persuasions at the time. When looking for “better angels” to inspire you, don’t think of political party or persuasion. Think of accomplishments in their “moments of truth”.

A final suggestion is to never fall into the trap of thinking that “better angels” are only perfect human beings. As humans, we can be judgemental some times. Here’s a suggestion on how to not fall into that trap. Think of how we celebrate Victoria Cross, Medal of Honor, and Croix de Guerre recipients; we celebrate their specific accomplishment(s), not the perfection of their lives.

If you are mostly a visual person, some have found the following helpful. Take a look/rewatch the movie “Dances with Wolves”; think about what it says to you about your assumptions/values before, during and after your viewing. Here is a partial list of other (click) videos that may inspire you.

What each of us needs today to get past the craziness of modern times is to find our own “better angels”. Each culture has countless sources of inspiration. They are around us everywhere. Immerse yourself in the sound of silence, AND

Search…Find…Be Inspired.

Find Your Inspiration.

Meaningful Reflections!

Dr. Bill DeMarco

High Performing Business Culture & Values

While preparing for a client meeting many years ago, I came across the value proposition of a consulting company my client had worked with in the past. Their value proposition had a lot to do with “optimizing the performance of human capital“. That was the first time I had heard this term. My first instinct was to cringe a bit at the notion of treating people like capital, but, on reflection and in the spirit of full disclosure, I needed to plead guilty of using this concept in the past. One of the ground rules of sound communications is to use language that the listener can relate to. In the world of business, the noun “capital” is truly capital as the Brits would say!

Its use has the ability to capture the attention of business leaders so we can get to the “good stuff”. In this case, the good stuff is to identify what’s required to bring about a high performing business culture. At my client meeting, we discussed about how, in my international research over the past decades, “treating people with dignity and respect” consistently correlated with sustainable high performing business cultures in a variety of business sectors and global cultures. It is a subset of what I call “Ethical Role Modeling”. I spoke about this on a business radio interview nearly twenty years ago. In more recent research, it still has resonance.

My reflections and client conversation on the merits of “treating people with dignity and respect” led me to a new insight. Isn’t “treating people with dignity and respect” similar to the Golden Rule of “doing to others as you would have them do to you”? After doing some research on world religions, I discovered that, interestingly enough, over twenty of the worlds great religions, which account for over seventy-five percent of the world’s population, espouse fundamentally the same “Golden Rule“.

My reflections and client conversation on the merits of “treating people with dignity and respect” led me to a new insight. Isn’t “treating people with dignity and respect” similar to the Golden Rule of “doing to others as you would have them do to you”? After doing some research on world religions, I discovered that, interestingly enough, over twenty of the worlds great religions, which account for over seventy-five percent of the world’s population, espouse fundamentally the same “Golden Rule“.

I know how, in our secular society, mixing religious with business values is frowned upon. BUT , maybe there is cause for thought when businesses as well as Buddists, Christians, Hindus, Jews, Muslims, Sikhs, and other beliefs espouse fundamentally the same core value of “high performance”. If the key to getting along in the new and emerging global community is finding common ground, this might very well be food for thought.

Meaningful reflections!

Dr. Bill DeMarco

The Challenge of Meaningful Reflections in a Sound Bite World

We live in a world where we have been conditioned by quick

sound bites. On radio and tv, it’s in ten words or less! No

matter what the medium, we insist on top line highly condensed information. We even learn speed reading…many advertisers go so far as to blast us with what I call “motor mouth advertising”…Look at Twitter, with its mandatory 140 characters.

Because of our hectic lives, our subconscious frequently cries out “spare me the details; I don’t have time for anything else!” We tend to view quiet time as either a luxury we can’t afford or an undesirable waste of valuable time. Even worse, we may have become so intellectually lazy we do not want to be challenged!

So what do we get from the quick sound bite approach to life? For starters, we get more time for more quick sound bites! More significantly, we take a whole lot of risk when we let others tell us what we should think, feel, do. A meaningful example would be how we get information needed to make intelligent decisions about important or meaningful matters in our lives.

In our work lives, many if not most have grown to prefer top

line or bottom line results over details. Since executives, managers, and supervisors set the example of what good looks like within business cultures, it doesn’t take long for subordinates to behave in kind within their work environment. “Spare me the details” becomes a lifestyle up and down the organization, ultimately leading to meaningful dialogue becoming a thing of the past within our work and even home environments. We just don’t know how to find the “off switch”. No wonder so many have difficulty falling asleep.

Another place to look at when thinking about our sound bite world is the world of contracts; computer applications and cell phone services contracts are most often encountered by people worldwide. They go on and on, written in language specifically designed to encourage the consumer to go to the “I accept” button quickly. We value short, crisp language, and these contracts are anything but. And then there is the legalese language of insurance policies, mortgage agreements, tax codes, or contracts of all sorts. Very few consumers are prepared to understand such documents.

There is also the example of how we consume newsin video or print formats. I had a friend many years ago who was a foreign correspondent for a prestigious and particularly well-written international newspaper. This was just prior to the days of CNN. I remember how appalled David was with the popularity of the new USA Today because its format was a collection of brief bites with catchy titles. Because it had almost no in-depth reporting, he called it “a ten minute read on a good day”!

In an ideal world, news should be information distilled and

interpreted from hundreds, thousands, and maybe even millions of bits of data. Our passion for getting to the point and “spare me the details” has all too often led to information passed off as News with little or no supporting data. My friend, David, was prescient about what this would lead to. I was not, at the time! Far too many societies/individuals have drunk the cool-aid of the unchallenged mind, and have grown to like it. In more recent times, it has even led to the shameful idea of “alternate facts”.

Thomas Jefferson wrote: “a society

that wishes to be free and yet uneducated

expects what never was and never will be“.

Jefferson was obviously calling for an informed civil society, but it has a wider application. We need to make room in our lives for meaningful reflections based on a lifetime commitment to personal education…finding enough data we can translate into information…immersing ourselves into other points of view, all leading to informed decision-making.

Health gurus have long written about the value of physical

stretching throughout our lives. This is a call for intellectual

stretching. Start with meaningful reflections. The minute we

stop learning for whatever practical reason is the minute we

become the manifestation of Eric Hoffer’s 1963 admonition:

“learners inherit the earth while the learned find

themselves perfectly equipped to inherit a world

that no longer exists“.

All of this cries out for a change on our part. It won’t be easy, but it is necessary! The bottom line is to never stop learning, whatever this means for you.

Create a daily environment of peace & quiet

Enjoy

Meaningful Reflections!

Dr. Bill DeMarco

[2022 update of an earlier article]

Corporate Bulimia: Why Current Profitability Models are Unsustainable & What to Do about It.

Corporate Bulimia:

Why Current Profitability Models are Unsustainable

&

What to Do About It

By

Dr. William (Bill) DeMarco, Ph.D.

_______________________________________________________________________

Abstract:

Over the past few decades, profitability has become almost the exclusive driver for most North American and European businesses, due to the unrelenting short-term profitability demands of their boards and shareholders. Of course short-term profitability is generally a good thing, but rarely so if it is driven by the purging of assets, resources, and capabilities which usually undermine the long-term viability of the enterprise. This short-term focus can be a “fool’s gold” model of what good performance looks like; it can also be a violation of the fiduciary responsibility of leadership to sustain the enterprise. Companies need to routinely invest/reinvest in resources and capabilities, if they are to survive for the long haul. Stockholders need to be educated about what good leadership really looks like, since most of their pensions are dependent on short, medium, and long-term stock performance.

Part One of this article points out why the current profitability model is unsustainable, and how we got here. Part Two is all about what truly inspired leaders can and should do about it.

_______________________________________________________________________

Part One

Profitability is the gaining of advantageous returns on investments. When I began my career decades ago, there was discussion about the role of service to customers, respect for employees, and service to the community as a major if not primary purpose for a business’s existence. That was still the era of mutual insurance companies, multi-generational company employers/employees, banks partnering with customers and the community for the general good, and company towns.

Much has changed since those days. We have experienced a steady diet of downsized companies, unemployment rates so severe that even unemployment statistics fail to count the millions who have just stopped looking for employment, entire key industry sectors eviscerated or just moved offshore, millions of minimum wage jobs replacing well paying pensionable jobs. Even mutual insurance companies, originally founded to perform some noble purpose for widows, orphans, and the general public, have almost all migrated to for-profit models.

Some companies have even lost sight of what their historic success was really based on, as they became addicted to alternate ways of satisfying their “new marketplace”: the stock market. To illustrate this, I once had a major Fortune 500 Company client that had a fantastic year-end in Europe, driven in no small part by the strength of the American dollar vis-à-vis the GermanDeutschmark. This significantly bolstered the corporation’s overall numbers. Their American overseers celebrated the “great performance” of the European part of the empire. Of course the corporate “leaders” on both sides of the Atlantic all received handsome bonuses.

In this case, like so many others I have known, we have an example of a “fools gold” model of what good corporate performance looks like. The reality was that the financial performance they celebrated had nothing to do with sound leadership, product development, superior market differentiation, or other leading-edge business practices. It was really the result of fortunate global issues beyond the control of the company’s leadership.

This became a new working model of good leadership performance; it became addictive. Eventually it became too late to get back to what was truly important. Over time, they invested less and less into areas which historically differentiated them from their competition. The company eventually lost the edge which made them an industry giant. They were not alone.

One of the most glaring examples of this obsession with finding non-core business ways to make the bottom line look better than it deserved to be can be found in the way pensions have been funded in recent decades. Defined benefit (DB) programs, once very highly valued for their secured pension fund savings, have mostly been replaced by defined contribution (DC) profit-driven models. According to a Bloomberg 2018 report, the reliance of both pension models on stock investments over the last decades has led to a significant underfunding of the pension reserves.

One of the most glaring examples of this obsession with finding non-core business ways to make the bottom line look better than it deserved to be can be found in the way pensions have been funded in recent decades. Defined benefit (DB) programs, once very highly valued for their secured pension fund savings, have mostly been replaced by defined contribution (DC) profit-driven models. According to a Bloomberg 2018 report, the reliance of both pension models on stock investments over the last decades has led to a significant underfunding of the pension reserves.

Feeling the profits-now pressure of most stockholders, company leadership very frequently failed to fund their pensions by taking “contribution holidays”; in Canada and the US, both federal and local governments that allowed this to happen were ostensibly trying to keep jobs within their jurisdictions. During that time, Ontario pension law was not significantly different from other North American jurisdictions. Companies that took pension fund “contribution holidays” hoped to achieve higher market evaluations, stock splits, and other market-related activities that would generate “money” more quickly.

Governments responsible for overseeing the funding of contractually agreed-to pension plans, allowed this, frequently charging an administrative fee for deferring funding company pensions, placing those fees into government general operating funds. It was hoped that the funds receive from these fees would put a “happy face” on the next financial report. The performance history of hundreds of stocks shows us that this is unsustainable; stocks that go up in value do eventually go down as well. That is the fundamental nature or the stock market.

All of this has led to a domino effect, not unlike families today relying on borrowed money (credit cards, lines of credit, home equity loans, etc.) to regularly meet their financial obligations…it looks good in the beginning until it comes time to pay the bills, or the income line slows down. This toxic combination of running out of resources/assets to”sell off”/benefits from administrative fees and the ” happy face” approach to putting a good face on financial statements most quickly deteriorates into a personal and corporate survival issue. Of course this is understandable at a purely human level, but this behaviour has little to do with sound leadership.

“Insanity is doing the same thing over and over again

and expecting different results.” – Albert Einstein

In the early to mid 1990’s, it seemed to work well for everyone. These diverted pension funds initially bolstered quarterly company and government numbers. Many pension funds even ran surpluses, while quarterly company profits looked rosy. As time went by, these under funded pension liabilities reached minor (1999) and not so minor (2008) tipping points as stock values deteriorated. Coupling these events with the ever-increasing number of retirees, even once venerable companies like General Motors frequently faced a perfect storm: ever-increasing underfunded pension liabilities, deteriorating value of corporate investments, and a rapidly growing number of retirees. The beat went on so relentlessly that by the end of 2011, 93 percent of federally regulated DB plans were under-funded according to the Office of the Superintendent of Financial Institutions of Canada.

The situation has gotten even more dire since then. For example, an August 2012 study by the credit rating agency Dominion Bond Rating Service Limited (DBRS) looked at 451 major corporate DB plans in the United States and Canada, including 65 north of the border. It found funding deficits of US$389 billion. DBRS noted more than two-thirds of the plans were “underfunded by a significant margin” and heading into a “danger zone, ” the point at which reversing the deficit becomes extremely difficult.As of 2018, with the highest stock values ever, these dangers have been masked for the time being; but hundreds of years of stock market history show that there will be a downward trend in the future. That “danger zone” is still lurking.

The situation has gotten even more dire since then. For example, an August 2012 study by the credit rating agency Dominion Bond Rating Service Limited (DBRS) looked at 451 major corporate DB plans in the United States and Canada, including 65 north of the border. It found funding deficits of US$389 billion. DBRS noted more than two-thirds of the plans were “underfunded by a significant margin” and heading into a “danger zone, ” the point at which reversing the deficit becomes extremely difficult.As of 2018, with the highest stock values ever, these dangers have been masked for the time being; but hundreds of years of stock market history show that there will be a downward trend in the future. That “danger zone” is still lurking.

I am not attempting to be critical of stockholders or pensioners here; they are on the receiving end of a profitability model which common sense would dictate is not sustainable for the long haul. Unfortunately, there ends up being multiple victims in this scenario… including stock holders/pensioners who rely on recurring profits for sustenance and lifestyle choice.

There are fundamentally two ways of achieving profitability: (1) grow the business through the judicious design and distribution of market-desired goods and services; (2) cut costs. The latter has become the dominant, and uninspired business/government means of obtaining more desirable numbers, because for all its management challenges, it is relatively easy to achieve and does not require much real business imagination. Of course companies need to be judicious with how they manage their businesses. However, there is an increasing obsession today with beating the analysts’ predictions, getting “bigger” , becoming the biggest in the industry at all costs, beating last quarter’s/year’s numbers no matter what, etc. etc. Executives of major companies enjoy hefty bonuses when this is achieved, frequently achieving seven and eight figures, irrespective of the sustainability of the means used to achieve such results. Company and government decision-makers have become too often addicted to the opiate of what I call “cut-cut, chop-chop leadership”, as if there is an endless supply of physical and human resources to be cut, or suppliers willing to provide goods and services for almost nothing. In this scenario, the temptation to cut salaries/benefits is great since human resource expenses account for over 50% of overall expenses for most companies; and the savings can go to the bottom line almost immediately.

Key business and government decision makers, including boards of directors, need to be weaned off of this addiction to “chop-chop cut- cut leadership”. This management addiction is absolutely not sustainable for the long haul; and the lure of this borderline unethical yet highly profitable practice for too many executives/ board members to sell off the company is so very tantalizing,. in spite of their fiduciary responsibility to sustain the enterprise. In 1957, the average life expectancy of a company in the S&P 500 index was 75 years. Today, it’s less than 15 years. I call this “corporate bulimia”

There is a better way. It requires inspiration, courage, and real leadership where the enterprise is given a real purpose, recognition in high places that making money is a result not a purpose, and stakeholders at all levels give their willing effort to support that purpose. This is not a call to go back to a bygone era of any form of utopianism (welfare/ social / Nordic/ Rhine capitalism). Rather, it is a call for a common sense that recognizes that current profitability models are unsustainable for stock values do go down. To make a real difference, senior executives need to think and behave for both the short AND long haul, rather than leaving this untenable situation for their successors to handle! Of course, this assumes that stockholders and their elected boards are interested in the long haul instead of cashing out for frequently obscene amounts of money when there is preci ous little left to cut, and selling/going offshore appear to be the only options left.

ous little left to cut, and selling/going offshore appear to be the only options left.

Let me offer an example. About twenty years ago, I was a senior executive at a major consulting firm. A client of our firm for many years was a global aerospace company, known for its decades of engineering creativity and performance. In recent years, they were having difficulty growing the business, mostly due to a risk-averse culture and leadership. The firm’s ceo and the board really needed positive year-end numbers to beat the buzz on the street about the company’s financial underperformance.

Since I was responsible for our Organizational Effectiveness Practice, our consultant responsible for the account asked me to come in to help the special ad hoc committee put together by the CEO to come up with some way to quickly improve the bottom line numbers. The reality was that the CEO had a white knight willing to “invest” several billion dollars for new product development, subject to agreeable year-end numbers. The committee chair was an executive vice-president. He and his staff had come up with one recommendation, which they wanted me to put our firm’s reputation behind when he presented it to the CEO. The suggestion was to implement an early out program for all employees over 52 years of age. The amount saved in salary and benefits would marginally surpass the targeted amount sought.

I asked two related questions: “Does an aerospace engineer with thirty-plus years experience have more business and technical knowledge/capability than an engineer with ten plus years experience? Why get rid of just about all of the knowledge, capability, and experience that distinguished the firm in the marketplace?’’ His response was they had that covered. They would hire back senior engineers as consultants as needed. If I was a stockholder, I would have been appalled with the idea of simultaneously paying out retirement benefits, generous exit packages and high consulting fees, while losing the resident capability that made the company great. My firm and I refused to support the idea.

To no one’s surprise, the company went ahead with the plan any way. The company beat the street’s year-end expectations… executives got hefty bonuses. Big headlines appeared in the Wall Street Journal a few days later; the company leadership was praised for their leadership. Most importantly, the company was bought up by a competitor in a fire sale less than two years later. Truly a long-term victim of corporate bulimia: risk-aversion and “chop-chop, cut-cut” leadership!

So what is a better way? Is it possible to be profitable now and for the long haul? What does a sustainable profitability culture look like? It starts off with leadership that gives purpose to organizational effort while inspiring willing effort to support that purpose! Part Two will cover some specifics.

Part Two

What to Do About It

All attempts to improve performance for the short and medium/long-haul must start with a vision of what is wanted AND what good performance looks like, and NOT just fixing what is not working! By only fixing what is not working will most likely fail to get us what we do want. We need to focus on what we do want.

The best way to cut the cord on “chop-chop cut-cut leadership” as the solution is to understand what real leadership is all about. I am writing about the kind of understanding that is internalized, thought through and fully embraced. Far too many of us quickly dismiss a lot of what I am going to say as kind of obvious, but, based on my years of experience, I know that is not really so.

1. Define leadership’s Purpose

Let’s start off with a working definition of leadership. Leadership is all about giving purpose to group effort, while inspiring willing effort to support that purpose.

The power of this definition, besides being field- tested in hundreds of situations, is that it works at two levels. (1) It provides a universal definition, which all stakeholders can understand; and (2) if properly conceived, can inspire employees, who represent a company’s greatest assets/costs, to give that extra effort when the times get tough and the enterprise is on the line. If properly conceived and implemented, it greatly helps minimize grousing about the nominal leadership, and greatly increases efficiency.

Not all people of title are leaders and not all people without title are not leaders. This applies to any individual who attempts to give purpose to what a group of individuals are doing. Without a working definition, just about any thing that is in the mind of everyone in the group will get in the way of progress of any sort.

Here are a few tips on what is required to “give purpose to group effort”.

2. Define the industry or industry segment your company/operation is part of.

Talk about stating the obvious but so many companies don’t ever really do this. If they did, we would not have the following missed opportunities or failures by otherwise great firms:

- In the middle of the twentieth century, the Swiss watch industry owned over 80% of the world’s watch market. Their CEH (Centre

Electronique Horloger) research lab dismissed the first digital watches because they had no mainspring…a critical element of how they defined a watch. They were really in the time keeping business and not the mainspring business. Their failure led to the current situation of having an 18.4% share of the world watch market, and no patent ownership of the quartz/digital technology as well.

Electronique Horloger) research lab dismissed the first digital watches because they had no mainspring…a critical element of how they defined a watch. They were really in the time keeping business and not the mainspring business. Their failure led to the current situation of having an 18.4% share of the world watch market, and no patent ownership of the quartz/digital technology as well. - Chester Carlson invented photocopying in 1938. Among other things, the technology uses mirrors and illumination. From 1939 to 1944, he approached over twenty companies to sell his invention. Two of them were Kodak and GE. Kodak recognized the importance of mirrors in his invention, but it failed to see how it fit within their model of photography. GE, on the other hand, understood the importance of illumination to his invention, but they defined themselves as being in the light bulb business. By 1948, Carlson joined forces with business partners to create XEROX .

- The train industry is the classic example. For decades, they saw themselves as being in the train business and not the transportation business. Hence, they lost significant commercial transport business to the trucking industry. It was not until the late 1950’s that they created the standardized steel Intermodal container, which started to reverse the trend.

- Edwin Land founded Polaroid in 1937 as an instant film camera company. The importance of that description became an organizational roadblock to embracing the digital revolution. Hence Polaroid, once one of America’s photography industry giants, failed to leap from instant film to “digital photography”.

There are many other examples. No matter how your organization defines itself, there is an ongoing need to reflect/define/redefine the industry/industry segment it operates in, and make this definition an integral part of the organization’s Vision/operational Mission.

3. Understand the Difference between Efficiency and Effectiveness

There is an obsession today with operational efficiency. I believe it is a byproduct of the obsession with MBA education, which is mostly about efficiency modeling. Efficiency is the creation of a system which optimizes performance within a single element of the business. Of course this is a good thing in theory, because it ideally eliminates waste and redirects all activities in one direction, which sounds like our definition of leadership. It is not! It rarely if ever tests the underlying purpose of the enterprise, and usually encourages the attainment of profitable numbers as its real goal. Efficiency needs to have a purpose within a higher order of things.

Primarily focusing on organizational efficiency is like a sports team having the drafting of the most accomplished player(s) at each position as its main success formula. The results are likely to lead to individual players earning a number of personal achievement awards, but the team is less likely to win the big prize. The reason is quite simple: teams need to play as more than a collection of high performing individuals, but rather as a collection of individuals inspired to achieve a common purpose especially when the going gets tough. What they should be looking for is seamless handoffs, self sacrifice for the greater good, and running plays that take advantage of optimal team performance.

For more on this, take a look at Henry Mintzberg’s controversial though highly respected 2004 book, “Managers Not MBA’s”. In this book,  Mintzberg, a much respected leadership and business scholar, writes at length about how just about all MBA programs focus on efficiency within silos. MBA programs generally provide high degrees of useful knowledge in operational efficiency, but that is not the only thing that is needed within organizations. What is needed to stop the “chop-chop cut-cut leadership” cycle, most often given in the name of efficiency, is true operational effectiveness. The difference between efficiency and effectiveness is what, the late-great organizational theorist, Russel Ackof, described as the difference between knowledge and wisdom. That is because organizational effectiveness focuses on institutional purpose and links all the “silos”into an integrated whole. To make this happen, both technical and human organizational effectiveness are needed. This combination will lead to superior product quality, greater competitiveness in the marketplace, better delivery systems, and a greater likelihood of achieving objectives.

Mintzberg, a much respected leadership and business scholar, writes at length about how just about all MBA programs focus on efficiency within silos. MBA programs generally provide high degrees of useful knowledge in operational efficiency, but that is not the only thing that is needed within organizations. What is needed to stop the “chop-chop cut-cut leadership” cycle, most often given in the name of efficiency, is true operational effectiveness. The difference between efficiency and effectiveness is what, the late-great organizational theorist, Russel Ackof, described as the difference between knowledge and wisdom. That is because organizational effectiveness focuses on institutional purpose and links all the “silos”into an integrated whole. To make this happen, both technical and human organizational effectiveness are needed. This combination will lead to superior product quality, greater competitiveness in the marketplace, better delivery systems, and a greater likelihood of achieving objectives.

There are several universities I am familiar with that try to get the efficiency/effectiveness balance right. They are Mintzberg’s programs at both INSEAD (in France) and McGill University (in Montreal), the University of Toronto’s new Institute for Management & Innovation (IMI), and the University of Guelph’s Master in Leadership program, which is designed around organizational effectiveness principles of cross-functional collaboration and alignment with the organization’s stated vision and goals. The latter program ideally should be paired with the knowledge derived from an MBA program, while the former university programs have more of an integrated efficiency-effectiveness design.

4. Put in Place Performance Management Systems, Based on Both Organizational Effectiveness AND Efficiency

Performance management is all about defining and tracking what good looks like within the organization. Once leadership’s purpose is clearly defined, an organization can align its technical and people systems to that purpose.

On the technical side, there are:

- enterprise resource planning (ERP) systems,

- enterprise planning systems, and

- customer relationship management software.

Enterprise systems (ES) are built on software platforms. Examples are Oracle’s Fusion and SAP’a NetWeaver.

On the hardware side, , enterprise systems are the servers, storage and associated software that large businesses use as the foundation for their IT infrastructure. They manage large volumes of critical data, and provide high levels of transaction performance and data security. More well known ES vendors are HP, IBM, Oracle among others.

At least as important as integrated ES systems are the integrated people systems. These have to do with:

- Recruitment

- People development

- Recognition and reward

- Promotion

- Succession

- Communications

Once technical ES systems are in place, it is too easy not to “spend t he money” required for integrated people systems. Beyond this, organizations which subscribe to the “Chop-Chop Cut-Cut Leadership” model will argue either that they have these elements in place already. As crazy as it may seem, the leaders of many organizations have even told me that people systems are not part of their core business model. My years of Organizational Effectiveness experience tell me that, in most cases, these and other popular objections are based on a lack of what Russell Ackof, called organizational wisdom. My Organizational Effectiveness (OE) consulting experience over the past decades tells me that Russell Ackof is on to something.

he money” required for integrated people systems. Beyond this, organizations which subscribe to the “Chop-Chop Cut-Cut Leadership” model will argue either that they have these elements in place already. As crazy as it may seem, the leaders of many organizations have even told me that people systems are not part of their core business model. My years of Organizational Effectiveness experience tell me that, in most cases, these and other popular objections are based on a lack of what Russell Ackof, called organizational wisdom. My Organizational Effectiveness (OE) consulting experience over the past decades tells me that Russell Ackof is on to something.

The answers to the following questions should provide insight into the effectiveness of an organization’s performance management system:

- Are the stated goals of the organization part of the organization’s definition of the leadership’s purpose, which is most often found in the vision of what is wanted AND what good performance looks like? If not, why?

- What were recent promotions primarily based on? Did it appear as if these promotions were based on the stated goals of the organization? Were you inspired to go the extra distance to support the goals on the organization as a result of this process?

- Are those who are held up as examples of what “good looks like” fundamentally represent the stated purpose of the organization, or are they primarily models of something else? Why?

Everyone knows that an organization which has two sets of financial books is probably up to something unsavoury, and puts its future at risk. An organization which has both a stated and unstated understanding of what good people-performance looks like also puts its future at risk because succession is a key part of its performance management system.

If you are particularly intrigued by the topics covered in this article, please contact me to find out how you / your organization can find out more.

Meaningful Reflections!

Dr. William (Bill) DeMarco